Understanding Flood Insurance

Flooding is the most frequent and expensive natural disaster in the United States. Yet, flood peril is not typically covered through most homeowners and renter's insurance policies.

What Are My Flood Risks?

With more than 20 percent of the National Flood Insurance Program's (NFIP) claims coming from outside high-risk flood areas those who live in areas with low-to-moderate flooding risk should understand their risk and consider flood insurance. The FEMA flood map service allows you to determine your flood risk. Risk levels are divided into three categories:

- High-risk areas have at least a 1 percent chance of flooding each year. Homeowners in these areas with mortgages from federally regulated or insured lenders are required to buy flood insurance.

- Moderate to low-risk areas have less than a 1 percent chance of flooding each year, but there is still a possibility the area could flood. Flood coverage isn't required in these areas, but it is recommended. Some mortgage lenders still require you to have flood insurance in non-high-risk areas.

- Undetermined risk areas are areas where flood-hazard analysis has yet to be conducted, but risk still exists.

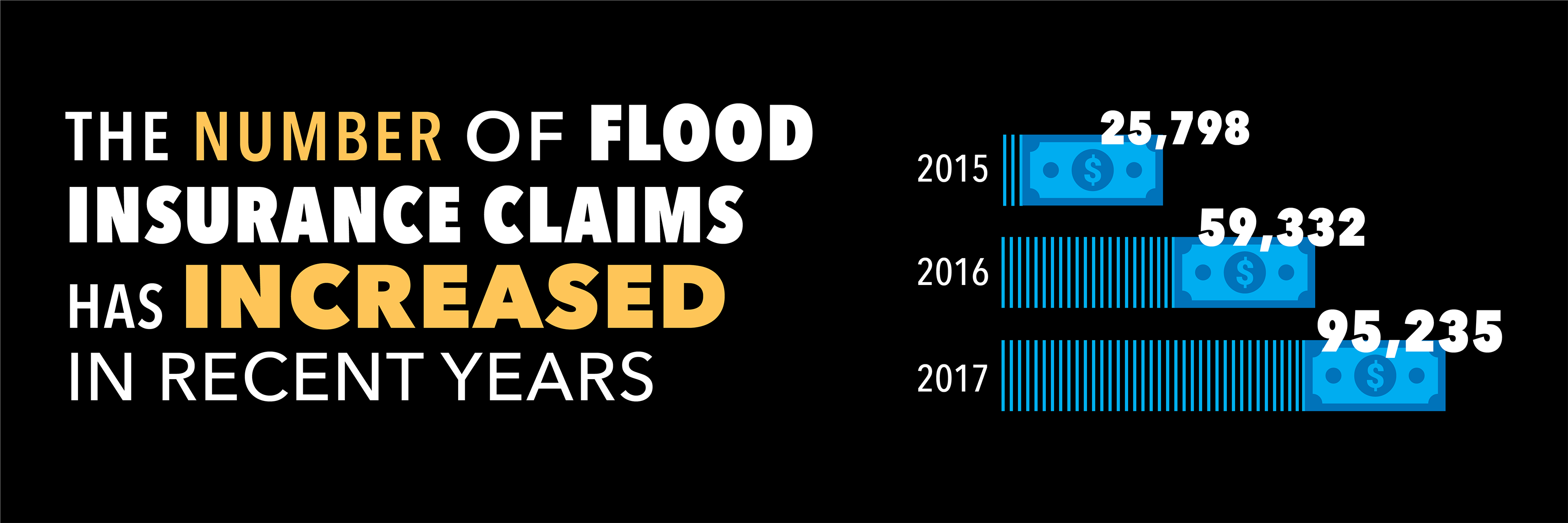

The Number of Flood Insurance Claims has increaces in recent years. 2015 - 25,798, 2016 - 59,322, 2017 - 95,235

Protect Your Home and Business

Flood insurance is a separate coverage that you can purchase through the National Flood Insurance Program (NFIP), which FEMA manages, or sometimes through a private insurer. Your agent may be able to assist you with an NFIP policy or a policy from a private insurer. For more about purchasing an NFIP policy, contact the NFIP Referral Call Center at 1-800-427-4661. For more information about private insurers writing flood coverage in your state, contact your department of insurance.

If you choose a private flood insurance policy, shop around and compare coverage and premiums before you decide which policy to buy. Be sure to ask about the waiting period. NFIP and some private flood policies have a 30-day waiting period unless a policy is bought at the same time as a newly purchased home.

Know Your Flood Policies

The NFIP standard flood insurance policy pays for direct physical damage to your insured property up to the replacement cost or actual cash value (ACV) of actual damages, or the policy limits of coverage, whichever is less.

Policy Comparison Homeowners Insurance Coverage: Leaking roof (unless dur to poor maintenance), Burst pipe, Bath tub overflowing, Damage to personal property from covered risks, water backup from an outside sewer (typically requires a rider). Flood Insurance Coverage: Structural or foundational damage up to $250,000 due to flood, Overflowing inland or tidal waters, Mudslide carried by a river or stream of water.

Homeowners Structure: NFIP policies cover up to $250,000 of flood damage to a home's structure, including:

- Damage to the furnace, water heater, air conditioner and floor surfaces (carpeting and tile)

- Debris removal and clean up

- Coverage for basements, crawlspaces and ground level enclosures on an elevated home is limited, so talk to your agent about any restrictions in the policy

Homeowners Content: Personal property inside your home is not covered under the Building Property coverage form. However, coverage is available up to $100,000 for an additional premium.

- Clothes, washer and dryer

- Television and furniture

- Other personal belongings

Business Owners: Personal property is not covered under Building Property policy form. However, coverage is available for up to $500,000 and an additional premium.

Private insurers may have higher limits or broader coverage than NFIP policies. Work with your agent in understanding a private policy and comparing it to an NFIP policy.